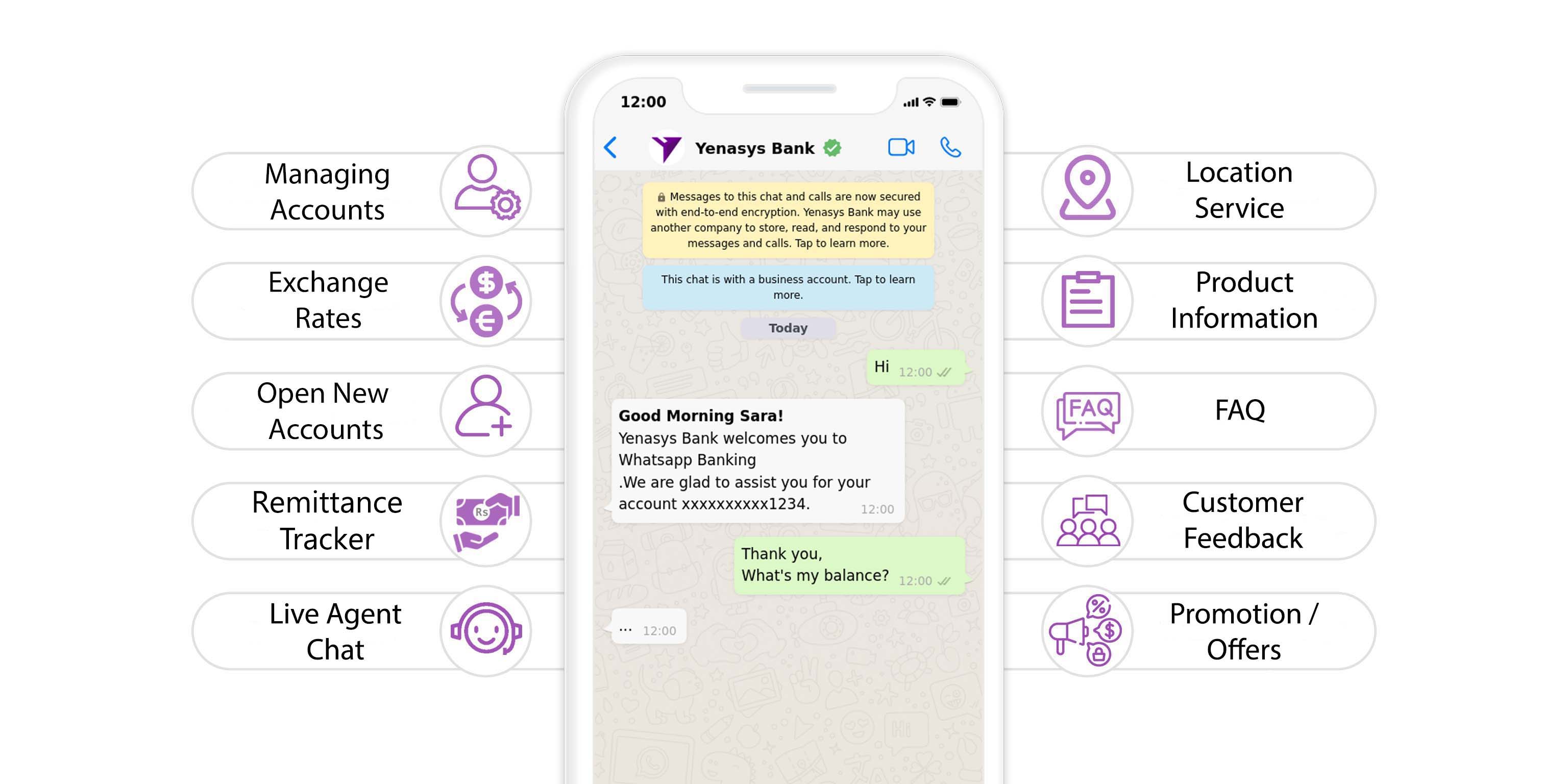

WhatsApp banking refers to the use of WhatsApp, a popular messaging application, for conducting banking activities and transactions. It allows customers to interact with their banks and access various banking services directly through the WhatsApp platform.

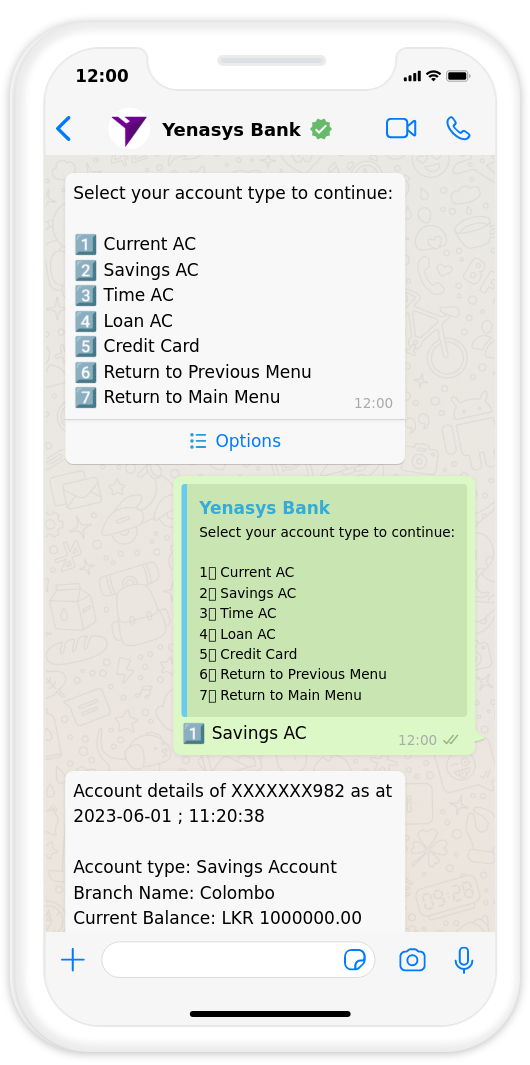

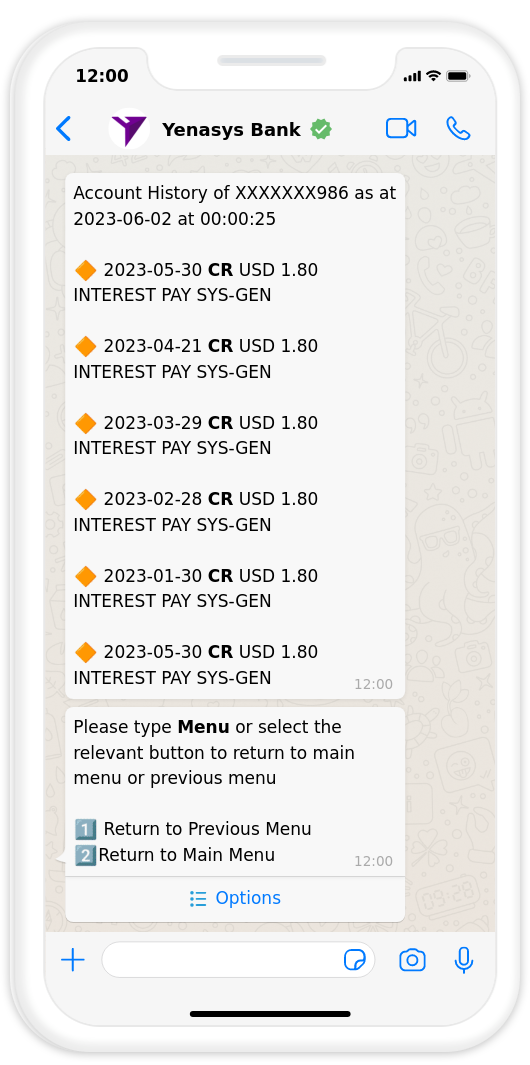

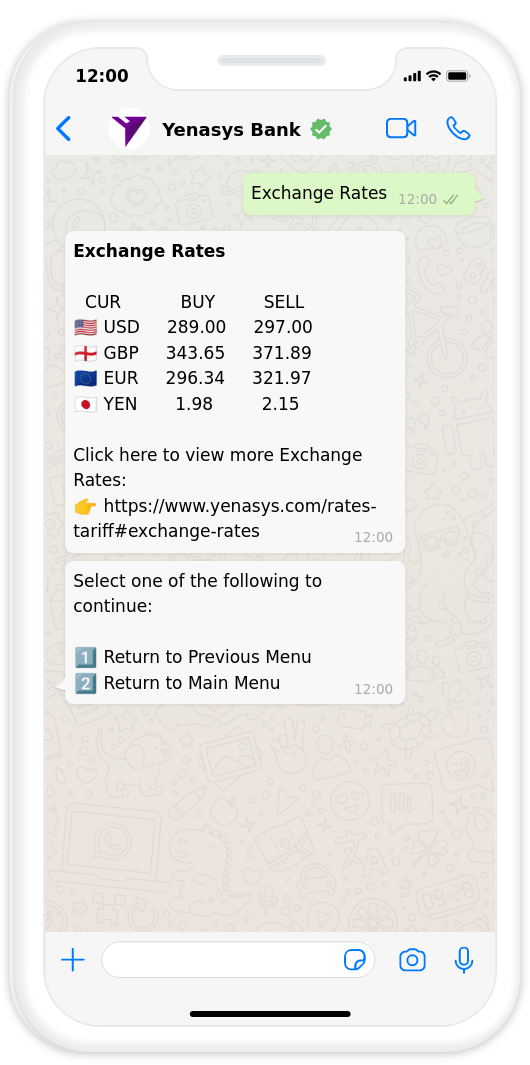

With WhatsApp banking, customers can perform a range of banking functions, including checking account balances, transferring funds, paying bills, requesting account statements, and receiving notifications and alerts from their banks. It provides a convenient and accessible channel for customers to engage with their banks without the need for visiting a physical branch or using a separate banking app.

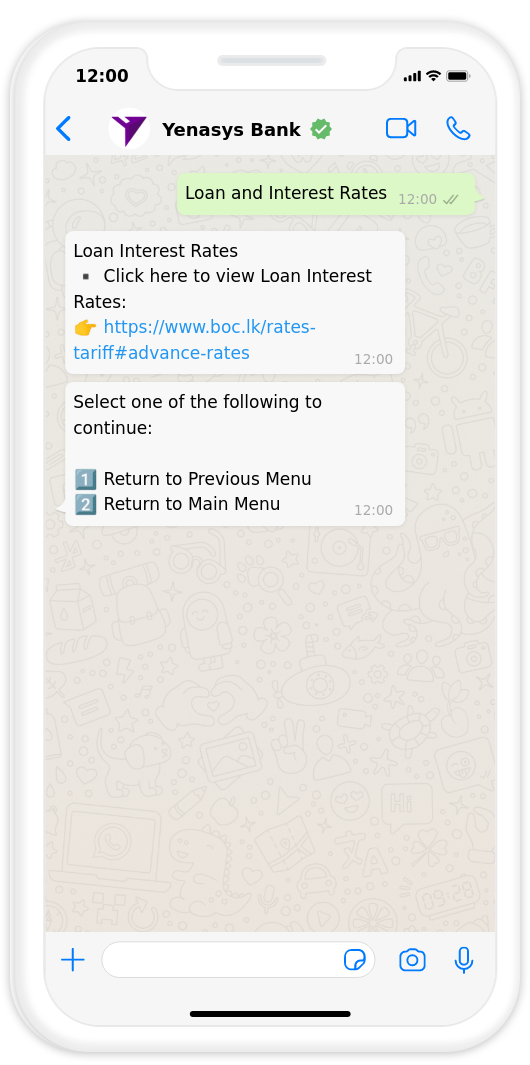

To use WhatsApp banking, customers typically need to have a registered mobile number with their bank and opt-in to the service. The bank will provide a dedicated WhatsApp number or a verified official account for customers to interact with. Customers can send messages, commands, or specific keywords to initiate banking transactions or obtain information.

It's important to note that the availability and functionality of WhatsApp banking may vary depending on the specific bank and country. Not all banks offer this service, and the services provided may differ between banks. It is advisable to check with your bank directly to see if they offer WhatsApp banking and what features are available.